Image credit: Unsplash

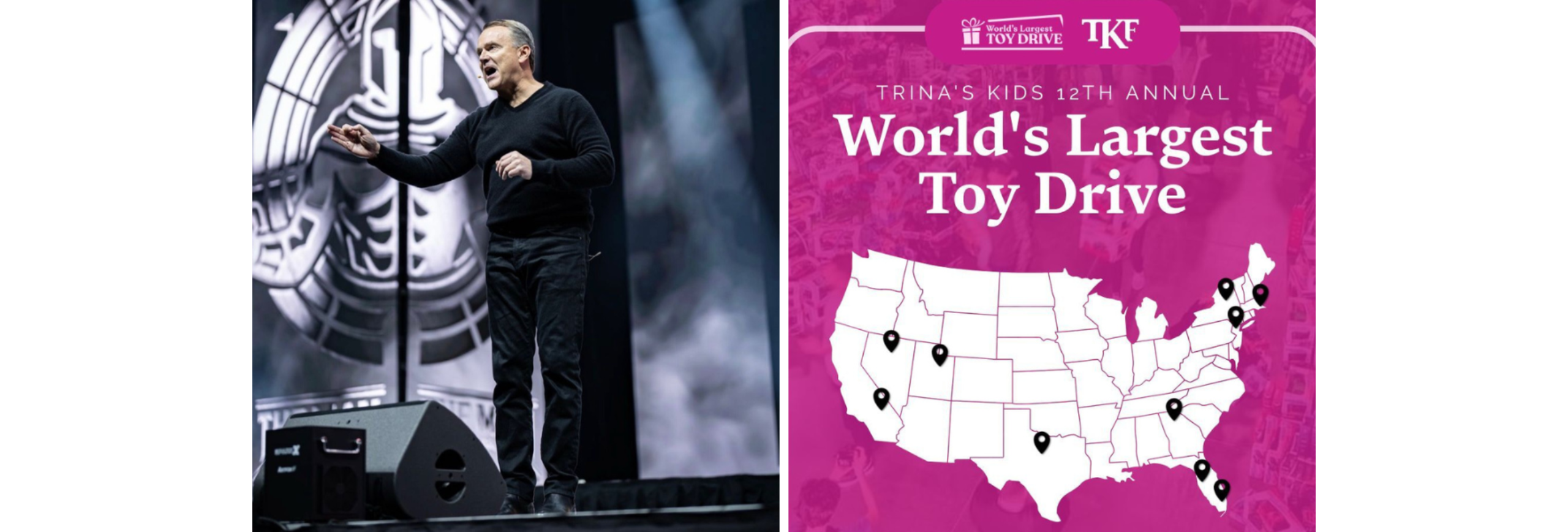

Southwest CEO Bob Jordan received flak from activist investor Elliott Investment Management on Monday, June 10 for Southwest Airlines’ “disappointing” financial performance during a time of heightened travel demand in the airline industry. Jordan, Elliott states, has underdelivered on operational and financial performance, necessitating new leadership from outside the company. This brought a public response from Jordan.

Jordan commented “I have no plans to resign,” as the CEO is already working toward considering changes to its open-seating policy, among other potential amendments that he hopes will improve the company’s financial situation.

“We want to understand what their ideas are, they may have great ideas,” Jordan remarked in response to questions about Elliott’s demands. “At the end of the day, we are going to treat Elliott like any other investor. We’ll sit down and listen to them… Southwest is a great company. We have a great plan and will execute.”

Jordan is also in the midst of conversations with Boeing, conveying some grievances with the manufacturer’s delays in sending out the 80 airplanes for this year. Southwest instead now expects to receive just 20 planes and likely will not be able to implement the use of the smaller MAX 7 until 2026 as the company waits for certification.

“We support Boeing doing the work to get better… Because a better Boeing is good for us for decades. We need Boeing to be very solid,” Jordan noted. “I’m not happy with the delays.”

Jordan visited with the Federal Aviation Administration on June 12 to discuss Boeing’s recent performance. He met with Boeing supplier Spirit AeroSystems on June 7; here, many of Boeing’s quality issues arose, and Jordan plans on seeing Boeing again in two weeks.

Potential Changes for Southwest Airlines Amid Financial Performance Concerns

Jordan later commented on Elliott’s proposed changes, noting they were “fairly light,” although he also stated they were considering a baggage fee despite Southwest showing upward of 50% of customers select the company because of their no-baggage fee policies.

“You’ve got to be very informed before you start proposing changes that affect the business model of Southwest Airlines,” Jordan noted. “Elliott is not directing the company.”

Other experts in the airline industry, such as Robert Mann, a one-time airline executive now operator of a consulting firm, commented on Elliott’s protestations over Southwest’s plummeting stock prices without support for real alternatives.

“Unless you have specific ideas in mind, it’s just kind of throwing grenades,” Mann said. “All you’re doing is saying, you don’t like what’s going on.”

Elliott, however, believes Southwest’s leadership is steering the company toward stagnation through its unwillingness to change.

“The mandate from the board has been clear: Keep doing things the way they have always been done,” Elliott said.

Jordan, meanwhile, claims the opposite, stating, “If customer preference tells us we need to evolve, we will evolve. You cannot be stubborn about change.”

“At the same time we’re going to stick to our values and our values say, ‘We treat people right. We have the best policies, we have the best people, we operate well,’” Jordan elaborates, “outside of that everything could be on the table.”