Image credit: Unsplash

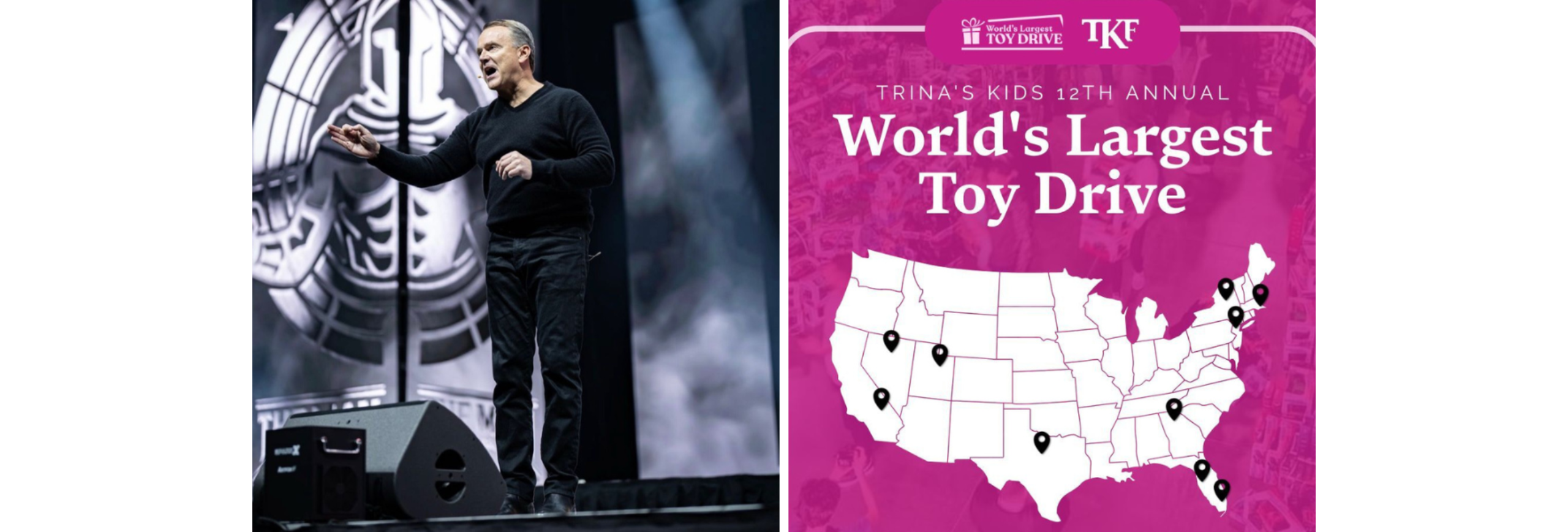

Vince McMahon, the iconic founder and erstwhile CEO of WWE, has once again made headlines by cashing in approximately $100 million from selling around 3.5 million shares of TKO Group.

TKO Group emerged last year from a high-profile merger spearheaded by Endeavor, combining the forces of UFC and WWE into a single entity, with Endeavor holding the majority stake. This latest financial maneuver by McMahon follows closely on the heels of a substantial $408 million gain from an earlier share sale this month, adding to a $670 million revenue from disposing of 8.4 million Class A common shares of TKO last November. In total, McMahon’s financial gains from TKO Group shares have reached the staggering sum of nearly $1.2 billion to date.

A recent SEC document revealed McMahon’s latest transaction involved selling his shares to an unnamed banking institution over a span of 15 days, from March 5 to March 25. “Upon the physical settlement of these shares, Mr. McMahon received, in aggregate, approximately $100 million from the Bank,” the filing stated. Following this sale, McMahon’s stake in TKO Group stands at 11.5 million shares, as per the latest update on March 28.

The SEC filings also disclosed that McMahon had used 3.484 million of his Class A shares as collateral in a prepaid forward contract with Morgan Stanley Bank. Furthermore, he has pledged another 7.17 million shares as collateral for loans from Morgan Stanley Private Bank. TKO Group indicated that the banks might sell “some or all” of these pledged shares if certain conditions outlined in the agreements are met.

In a twist to his corporate saga, McMahon stepped down from TKO Group’s board in January amidst allegations of sexual assault and sex trafficking by a former employee, charges that McMahon vehemently denies. Following his resignation, which came amid pressure from the TKO board, he forfeited 86,918 shares of unvested stock units, valued at $7.5 million, according to another SEC filing.

Despite these controversies, TKO Group, buoyed by the UFC and WWE merger, reported a banner year in 2023. The conglomerate saw record-breaking revenue and sponsorship deals, with a combined operational revenue of $2.62 billion — an 8% increase from the previous year — and net income rising to $241.5 million, a significant jump from $60.1 million in the preceding year.

McMahon’s recent financial activities and the operational successes of TKO Group underscore the evolving landscape of the entertainment and sports industry, highlighting the lucrative potential of strategic mergers and the complex dynamics of high-profile leadership amidst legal challenges.