Image credit: Unsplash

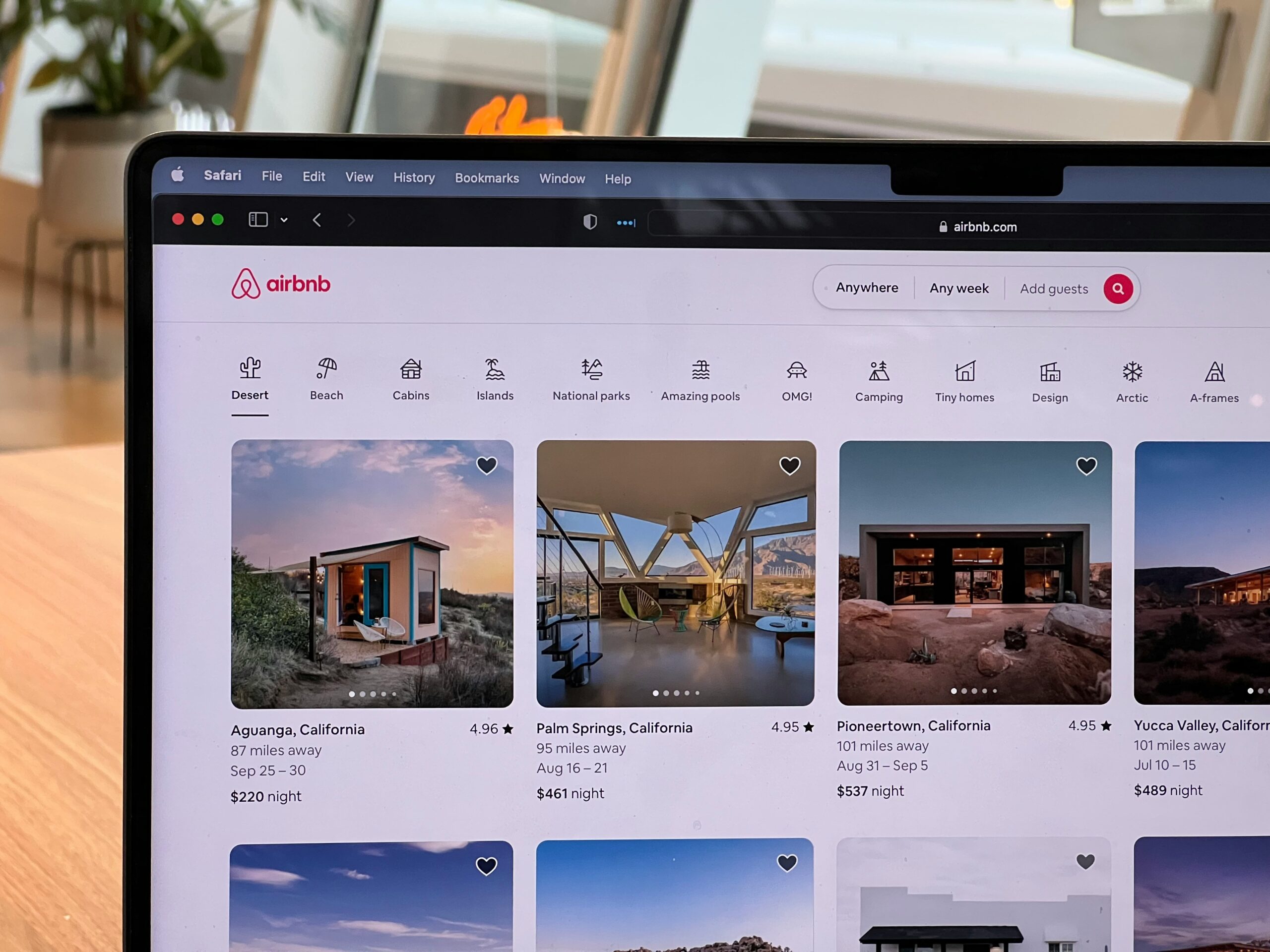

Though internet casino gambling is only legal in a few states, some in the industry are convinced that the practice is the future of betting.

Last Wednesday at the SBC Summit North America—the major gambling industry conference—executives acknowledged that they’ve had difficulty in expanding the legislation of online casino games. However, they remain certain that the future of gambling is online.

Elizabeth Suever, a vice president with Bally’s Corporation, said, “Once you get to millennials, people are comfortable basically running their entire life off their cell phone. This is where gaming is going.”

However, even despite the surge in popularity, online gambling is not reaching quick legal status in many states. Only seven U.S. states currently offer legalized online casino games. These include Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, Rhode Island, and West Virginia. Nevada offers internet poker, but not online casino games. This contrasts with 38 states plus Washington D.C. which offer legal sports betting, the overwhelming majority of which is done online, and mostly through cell phones.

When the U.S. Supreme Court opened measures to make legal sports betting in any U.S. state, the bets “took off like a rocket,” according to Shawn Fluharty, a West Virginia legislator, and the president of the National Council of Legislators from Gaming States.

“Many people thought i-gaming would follow suit,” Fluharty said. “That has not taken place.”

Brandt Iden, the vice president of Fanatics Betting & Gaming, agreed with Fluharty’s assessment by stating, “It’s been a rough road,” adding, “I-gaming is paramount; this is the direction the industry needs to go to be successful, and this is where consumers want it to go.”

When Deutsche Bank issued a research note last month stating that it is likely a matter of “when, not if” internet gambling in Atlantic City overtakes revenue from physical casinos, panelists found some agreement.

They claimed that the industry needed to do a better job of educating lawmakers about internet casino games, and drew comparisons to the illegal, unregulated offshore websites that attract customers all over the country. Legal sites would offer strict regulations and protect customers from fraud, as well as include responsible gaming options such as self-imposed time-outs and activity limits.

Cesar Fernandez, a senior director with FanDuel, said that online casino games should prove to be increasingly attractive as federal post-pandemic aid dries up and that U.S. states could bring in new revenue without the need to raise taxes. Fernandez claimed that, since 2018, FanDuel had paid $3.2 billion in taxes. “That’s a lot of teacher salaries, a lot of police officers and firefighters,” he added.

The industry has cited several challenges to a wider approval of casino gambling. This includes fears of increasing addiction by “putting a slot machine in people’s pockets,” Iden said and added that casino companies needed to implement more player protections.

These issues, combined with whether internet gambling cannibalizes internet casinos, remain prevalent. However, many in the gambling industry have stated that the two types of gambling can complement each other.

However, some casino executives have said that their internet counterparts are hurting the revenue of their brick-and-mortar stars. Rob Norton, president of Cordish Gaming, has been the most vocal in raising the alarm that online gambling will do this. “We’re setting ourselves up for our own failure,” he has stated.

Norton has stated that in-person sports betting revenue in the company’s Maryland Live! casino declined by 65% “and has stayed there.” He added that there has been a decrease of around 7,000 people per day, and that may be one reason why online casino games have not spread more widely.

Adam Glass, an executive with Rush Street Interactive, an online gambling company, has stated that his firm has a relationship with physical casinos, and works hard to be “additive” to them, claiming that online gambling can also be a job creator. This takes effect not only in designing and operating the games themselves but also in industries such as marketing and media.

Quincy Raven, the U.S. managing director of NeoGames Group—a technology company that has been recently acquired by Aristocrat Leisure Limited—has stated that what may appear to be cannibalization to one person may be successful business to another company. He elaborated, “That’s not cannibalization; it’s just competition.”