Image credit: Unsplash

In a big shake-up for the entertainment world, Skydance Media’s $8 billion takeover of Paramount Global was announced, with the deal set to wrap up in the first half of 2025, pending regulatory thumbs-ups. Until then, Paramount Global’s current leaders, co-CEOs Brian Robbins, George Cheeks, and Chris McCarthy, stressed it will be “business as usual.”

A Strategic Move for Paramount

This acquisition marks a crucial chapter in Paramount’s saga. Skydance Media, under David Ellison, will take the reins, with Ellison as the new chairman and CEO. Jeff Shell, ex-NBCUniversal chief, is lined up to become president of the newly minted conglomerate. Shari Redstone, Paramount Global’s main shareholder, acknowledged the contributions of the co-CEO trio and highlighted the strategic smarts behind the deal.

In a note to staff, Redstone praised Robbins, Cheeks, and McCarthy for their steady hand during the transition and strategic pivoting. She explained that the Skydance deal aims to set Paramount up for future success and boost shareholder value.

The co-CEOs reaffirmed the company’s commitment to its game plan, which involves modernizing operations, streamlining teams, and trimming workforce overlaps. Paramount Global is also talking with potential partners to snag financial stakes in Paramount+ and is prepping for the sale of BET Media. These moves are designed to slash overhead costs and optimize the company’s asset portfolio.

Synergy and Future Prospects

Paramount Global’s nearly $15 billion in long-term debt worries folks about its streamer survival in a cutthroat market. However, the company still packs a punch with assets like CBS, Nickelodeon, MTV, BET, Showtime, and streaming champs Paramount+ and Pluto TV.

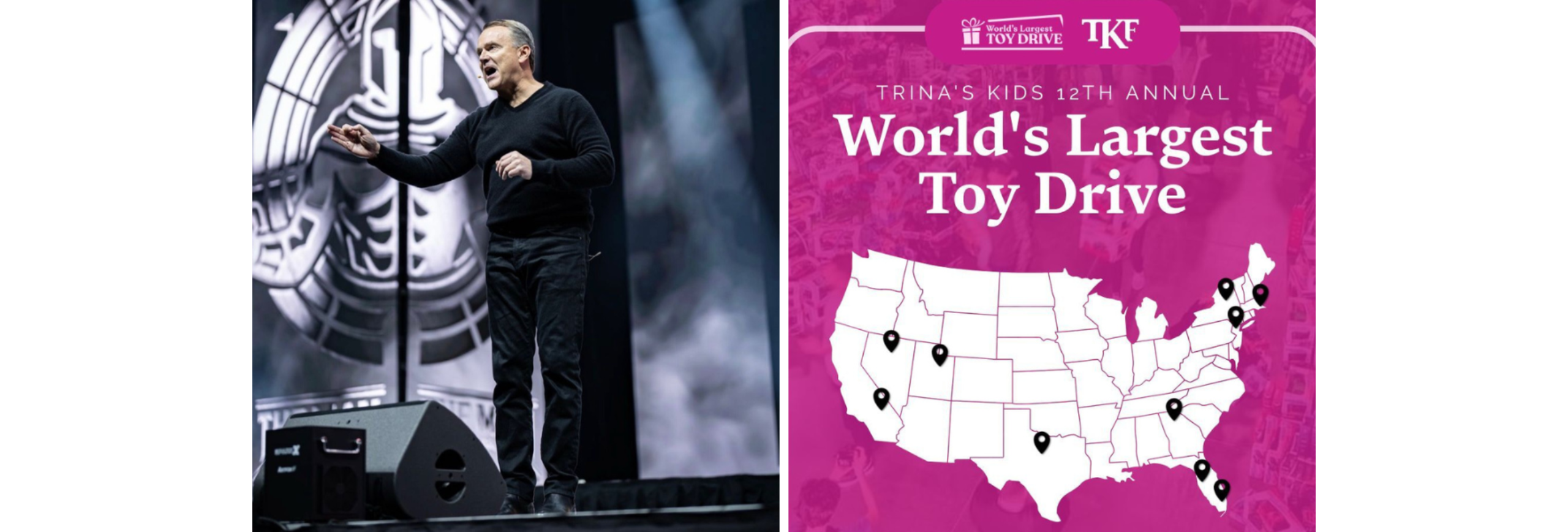

The co-CEOs shared their vision of the synergy between Skydance and Paramount, emphasizing that Skydance’s financial strength and cutting-edge technology will enhance Paramount’s iconic IP and vast film and TV library. This partnership has produced successful films like Top Gun: Maverick and Mission: Impossible – Fallout, hinting at a promising future.

Paramount’s Board of Directors has a 45-day window to consider other buyout offers, though Skydance’s bid looks strong. Paramount Global shares inched up 0.17% to $11.83 after hours, showing cautious investor optimism.

As media consumption and tech race forward, the merger aims to build a powerhouse in traditional and streaming realms. The co-CEOs highlighted Paramount’s storied past and bright future, thanking staff for their dedication and grit.

The shift, driven by the vision of Shari Redstone and the Redstone family, is set to strengthen Paramount’s standing as a global entertainment giant. The co-CEOs thanked the board of directors and the Paramount team for their relentless efforts to propel the company forward.

Employees have been assured that they will be kept informed throughout the transition process, with further details available in the official press release. This commitment to transparency and communication promises to blend the strengths of both companies, paving the way for a dynamic and innovative future in entertainment.